On a Contempt of Court Petition (CCC 674/2020) filed by the Samaj Parivartana Samudaya, alleging inaction on the part of the Government officials to implement the earlier order of the Karnataka High Court, the Division Bench headed by the Hon’ble Chief Justice warned the Government officials that it would initiate contempt of court proceedings if the earlier order is not implemented.

The Court heard the submissions of Mr. A.R.Goutham, Advocate for S. Basavaraj, Advocate, Daksha Legal. PDF of contempt petition below

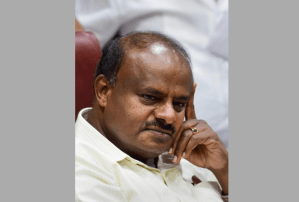

Facts of the case. Samaj Parivarthan Samudaya – SPS had filed a Public Interest Litigation in Writ Petition 49/2020 seeking directions to the Government of Karnataka to take appropriate action against H.D. Kumaraswamy, D.C. Thammanna and Savithramma for violating various provisions of law dealing with agrarian reforms in the State of Karnataka and also for illegally grabbing lands. SPS also sought a direction to the State Government to implement the order of the Lokayukta in this regard. Hon’ble Court disposed the Writ Petition on 14:1:2020 recording the undertaking of the State Government that it would take action within three months.

The Karnataka Lokayukta’s order dated 5:8:2014 related to major land grabbing involving around 200 Acres of land (including 110 Acres of Gomala Land) by H.D. Kumaraswamy, the former Chief Minister of Karnataka, his close relatives and associates D.C. Thammanna, the former Minister for transportation and his sister- in law Savithramma.

In the relevant portion of the Lokayukta Order, it has been mentioned that Survey No. 7,8,9,10,16 and 17 in Kethaganahalli Village of Bidadi Hobli in Ramanagara Taluk comprising of village common lands in total measuring 110 acres and 32 guntas of Government Pasture Lands (Gomala Land) which the Karnataka State Government had earmarked for public usage such as Lake, Burial Ground and to persons belonging to Scheduled Tribe (ST), and Scheduled Caste (SC), for irrigation purpose has been encroached by various persons.

The encroachment of the granted lands by H.D. Kumaraswamy, D.C. Thammanna and Savitramma is reflected in the letter of the Assistant Commissioner, Ramanagara dated 25:8:2014 under the subject “Ex-Chief Minister Shri H.D. Kumaraswamy, other family members and his close relative MLA Maddur Shri D.C. Tammanna, his family members have grabbed 200 Acres of land including 110 Acres of Gomal lands that needs to be restored to Govt.”. The Assistant Commissioner enclosed a detailed 10 page report entitled the same as the subject of the said letter.

The order of the Hon’ble High Court having not been implemented, SPS approached the Court on the contempt side. The Hon’ble Court expressed its displeasure today over the inaction on the part of the Government and warned that if the order is not complied with in letter and spirit, appropriate contempt of court proceedings would be initiated against the officials concerned.

The matter is adjourned to 16 February 2021.