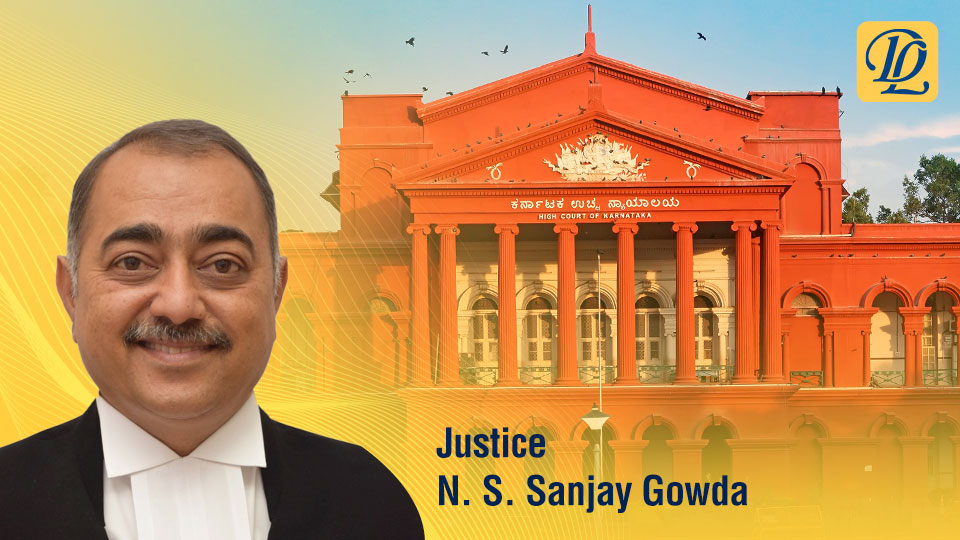

Justice N.S. Sanjay Gowda celebrates his 57th birthday today.

Hon’ble Mr. Justice Neranahalli Srinivasan Sanjay Gowda was born on 15.02.1967. His father Shri. Srinivasan was a leading Advocate in the Karnataka High Court known for his fearless submissions protecting the interest of statutory bodies like Bangalore Development Authority.

He was enrolled with the Karnataka State Bar Council as an Advocate on 31.08.1989. Justice Sanjay Gowda was appointed as Additional Judge of the High Court of Karnataka and taken oath on 11.11.2019 and Permanent Judge on 08.09.2021.

Important Judgments delivered by Hon’ble Mr. Justice N S Sanjay Gowda.

Manufacture of Ethanol using sugarcane juice, sugar or sugar syrup is a sugar factory as defined under Clause 2(c) of the Sugarcane (Control) Order, 1966. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/0A1TaJ32cV7aTS49HeJNkIbGq

Service Law. Seniority. Persons promoted in excess of backlog vacancies shall be continued against supernumerary posts. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/LMr4NFvJ4mBcPKDIwDIIluKYP

Karnataka Municipalities Act. Deputy Commissioner in exercise of powers under Section 306 cannot act as an appellate authority and decide validity of the resolution passed by the Municipal Council. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/M65tC954EcnNizIP7tOmUVsdC

Equal Pay for Equal Work. Workers employed directly and through Contractor. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/QHh28whifDMGlIs0thZTT2Stv

Karnataka Stamp Act, 1957. Intending purchaser already in possession prior to agreement of sale. Purchaser has to pay stamp duty as if possession delivered ‘under the agreement’. Stamp duty cannot be avoided by relying on prior possession.

https://www.dakshalegal.com/judgements/actionView/P9Af00pxLLnSEjwjORu28sN2y

Right to seek reference to arbitration is not lost if application under Section 8 is filed along with written statement.

https://www.dakshalegal.com/judgements/actionView/MBT0VvEjk8n3LmjfYyNs7dNGV

Karnataka Housing Board Act. Sanction of scheme by the State Government is mandatory before the Board takes up housing land development or labour development schemes. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/02hMVMNKUWVpNsFjZJTsLahFl

Land acquisition. 2013 Act. Lapse under Section 24 is only when acquisition was under 1894 Act. Section does not apply to acquisitions under State enactments. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/8ZucmAjxZVTjmMQ5RCdc01AdW

Karnataka Municipal Corporations Act. Power to remove encroachment cannot be used to unilaterally determine encroachment of Government land and call upon the alleged encroacher to vacate and deliver possession. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/7WcxtylQlc8uLhxXMyT8rwqXS

Locus Standi. When a litigation is filed in private interest and not as PIL- fundamental principles pertaining to locus standi have to be complied with by demonstrating violation of petitioners rights and in what manner. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/tz0GB17AdDxrOETKUDvDpndBc

Preventive detention. Though writ petition challenging detention order even before the actual arrest is maintainable, interim stay of such order and grant of bail to accused is unsafe and hazardous. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/4j5PJQjDa03SuxnIXofVVdzmp

Karnataka Municipalities Act, 1964. Constitution, abolition etc of smaller urban areas. Governor should form an opinion that objections to the proposed notification being insufficient or invalid. Non compliance renders notification invalid. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/kQUlIgQjcWFpDzOwYDtTFC1I1

Indian Succession Act, 1925. Wills. Latest judgment of the Karnataka High Court on ingredients, revocation, alteration, proof of Will and evidence of handwriting expert.

https://www.dakshalegal.com/judgements/actionView/WxZaN7CoQ8pEbGxrYXprtXyON

”Classic case where the political parties and the police tried to bury the truth”. Karnataka High Court upholds CBI investigation against former Minister Vinay Kulkarni and others in a murder case.

https://www.dakshalegal.com/judgements/actionView/v7Pa2mpJs6qZQ5R0lCXbOIVex

In-service employee appointed to new post in new department on direct basis submitting technical resignation to his post. He cannot be repatriated to original post if new employer discharges him from service. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/ZrAJ93VDXt4mj9mKYOTSZlS6P

Right to Information Act, 2005. There is no bar to furnish ‘B’ Report under RTI Act once the investigation is completed. Bar for grant of information applies only during investigation. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/GomnXx7OLyt9qwnhKbwDqugds

A document cannot be registered unless the executant personally appears and establishes his identity to the registering officer and admits execution of the document under Sections 34 and 35 of the Registration Act. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/LMI6SmxPsEC9lymI79MTY63QQ

Labour law. When model standing orders are amended to enhance retirement age, trade unions can seek modification of the certified standing orders to bring them in conformity with the model standing orders. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/3A29Rtrx02O7HpM5nDICLhGwb

Karnataka Land Reforms Act. Order of the Tribunal without bringing all the legal representatives of the deceased landlord on record is a nullity in the eye of law. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/PEBY8WpssdnCSKtPDLqNTjLLX

Forfeiture of occupancy under the Karnataka Land Revenue Act, 1964 for non-payment of land revenue. Owner can pay the arrears of land revenue any time before the property is sold and get the land restored. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/Lemg7LYNYd9q6AlkDCQ14RMqN

In respect of lands notified prior to 1 January 2014 under the KIAD Act, if awards were not passed as on that date, awards are required to be passed only under the 2013 Act. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/XUTa3lwcoAkb2owbO8TCznbAz

Karnataka Land Revenue Act. When grant of lands is held to be valid, embarking upon a fresh enquiry regarding the revenue entries is impermissible. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/gjzJfi5gISPGZDmGlqp1T2vGH

MVC claim. ‘Pay and recovery’ principle applies even when owner of vehicle contests claim petition or has preferred appeal against award. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/LnMKavEzAkGJhLev3BpB2WiXL

Karnataka Land Grant Rules,1969. When temporary lease of land is confirmed upon expiry of the lease period and on payment of fixed price, the Deputy Commissioner cannot impose condition of non-alienation. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/3zs4tUOWDlpeVTpf6SIOheK9y

Farmers cannot be deprived the benefit under the Minimum Support Price Scheme simply because they did not register under the Web-Portal set up by the Department. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/ekNXz8riWHNZwXMsUdEXGuHBh

Mere stay of a judgment in appeal would not preclude the Court from following the dictum laid down in the judgement. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/Fb9xwN5I0yiPLG8TznsU9nu95

In respect of lands notified prior to 1 January 2014 under the KIAD Act and in respect of which an award has not been passed as on that day the awards are required to be passed under Section 24 (1) (a) of the 2013 Act. Karnataka Court.

https://www.dakshalegal.com/judgements/actionView/wgnf7dixaETclAMCWlnfJzVq4

Sale of immovable property cannot be invalidated by a subsequent declaration notifying the property as Wakf property. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/Jy9Q9Xy7XVDUK3eJxfAHnaVQL

Karnataka Municipalities Act. In case of incomplete or incorrect property tax return, the Municipality has a right to assess property only for a period of six years and not beyond it. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/7ZGMoMxIQ3GFx1KV86cDoiAhK

Once an instrument is admitted in evidence, even by inadvertence, the admissibility of the document on the ground it was insufficiently stamped cannot be questioned thereafter. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/EoYkRllISz2LhCxcav663AlHF

District Court has no jurisdiction to direct the Trial Court to examine the admissibility of a document on the ground of non/under stamping after it had been admitted in evidence. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/AiLX9XpDPNX2QINPhTDT9HRfb

Anti Defection Law. In the absence of any steps taken to serve whip in the manner known to law i.e., RPAD and courier or by personal service, mere affixture of the whip on the door is not sufficient. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/sxYhhsgKb4eBAnV7KVJdWOuzw

Karnataka Local Authorities (Prohibition of Defection) Act. Karnataka High Court issues guidelines regulating service of whip.

https://www.dakshalegal.com/judgements/actionView/W18eKIrt54InIx3z9nT3Lki06

National Highways Act. Disbursement of the compensation cannot be withheld or delayed merely on the ground that the award is sought to be challenged. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/ivyAaglpgUqbW2UMPnxO8IbOd

Persons having tenancy rights can challenge acquisition proceedings initiated under the 2013 land acquisition Act. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/eD2t4mQlfHC7SXvsahrCxihN9

Motor Vehicles Act 1988. Rider of a borrowed vehicle can claim compensation under Section 163A for the death of pillion rider wife even though he steps into shoes of the owner and is responsible for the accident. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/1fSuYu7XrZx0chw8ZMs3Fqo0h

Tax on electricity payable by consumer shall be on the basis of rate at which consumer purchases from Open Access Source and not at the rate at which the licensee sells to its consumers. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/9WVXrEY87HXBM3VeqQAW4kc9e

Suit for partition. Plea of exclusive possession by the purchaser of coparcenery property is NOT a conclusive factor to determine court fee payable by the plaintiff. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/Zr3dnpFd2lwm8d0XTm0P94ccv

Revenue officers cannot go into the validity/correctness of the Order based on which the revenue entries are sought be made in the land records. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/FQD6xdppY88yG77I438k3Mwmd

Suit for partition. A person who is not a party to alienation of coparcenery property need NOT seek cancellation of sale deed or a declaration that he is not bound by the alienation. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/0jpPcSN2LoiHu6PkaVTZpyWwl

Suit for declaration in respect of non-agricultural lands. Court fee payable is NOT on the actual and prevailing market value of the land. Criteria is 15 times the profit or 30 times the revenue. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/MZxdpezuCF4GnuVC55k5fQBih

Suit for permanent injunction in respect of immovable property can be continued by legal representatives after death of original plaintiff since right to enjoy possession is a transferable right. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/b9qwjQO1eMAubiqU39ZQFbOMk

Second marriage solemnised before coming into force of the Hindu Marriage Act, 1955 is valid. Children born from such marriage are legitimate children for the purpose of succession. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/jjaLp0VP31MFrgTBf2a8OCadf

Amended Section 6 of the Hindu Succession Act applies even to woman who died before 2005. Legal representatives are entitled for share in the ancestral property. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/C3m2eGRHuJVlBw8lUbKJ4k4c3

Motor Vehicles Act. In the event of an accident resulting in death or injury to employee, in the absence of a restrictive clause, liability of insurer cannot be limited to liability prescribed under the Employee’s Compensation Act. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/iAoV17bT8JnwBluYtGCasJPlN

Motor Vehicles Act. Person who has a driving licence to drive a light motor vehicle can also drive a transport vehicle which has an unladen weight less than 7500 kg. Insurance company is liable to pay compensation. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/dQxD84IpK9CvLI0cU2oTDafnb

Cause of action in a partition suit is a recurring action. Dismissal of earlier suit for non-prosecution will not be a bar for filing a second suit for partition. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/JovsgCgK3bGQnz5i0jOqFo4xM

Both “A” and “B” Kharab lands belong to owner of the land. Landowner is entitled for compensation in case of acquisition of kharab land. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/5sTvvHPgXeozkW9Fy5mwj843N

Wakf Board has no power to issue a corrigendum to the list of wakfs published in the gazette under Section 5(2) of the Wakf Act, 1954. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/XCqxaQXDtd29M7OyfP8UlGvTz

Compensation for lands notified prior to 1:1:2014 under the KIAD Act, where award is not passed as on 1:1:2014, is to be paid under the 2013 land acquisition Act. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/V58GdJqKnvMkca1zJcSFnlUpe

Right of the defendant to file a separate suit for partition in respect of properties not included in the plaint is not barred merely because he did not make counter claim in respect of the omitted property. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/DZSdquWupXXXmQOyavjO669xV

Suit regarding public trust. It is not necessary that the plaint with documents shall be filed only after the leave is granted. The Court can form an opinion to grant leave on going through the pleadings. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/cv9OdKmw4Pb8xZctxrmM6JFli

Prevention of Corruption Act. ‘’According approval to investigate’’ is different from ’Sanction to prosecute’’. It is mandatory to obtain two different and separate approvals for investigation and for prosecution. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/5cRTlul2g2IIhZue6kkeqqIPH

Prevention of Corruption Act. Material furnished by the Investigating Officer need not be subjected to a microscopic examination before according approval to investigate a public servant. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/iCwzJzyapwkpglZKs8u6mGt7Z

Upon death of plaintiff, right to sue survives only on the legal representatives. Person claiming a contractual right from the deceased plaintiff cannot come on record as co-plaintiff. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/Eeat8DWGEkbq7fACeczKIxIDE

Hindu Minority and Guardianship Act. Court is required to take into consideration the interest of the minor and safeguard the minors’ interest while granting permission to sell minor’s property. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/Gp042KeUkTKFUz5wLcQZ0IDUX

Unauthorized occupant of Government land has no right to invoke plea of adverse possession against the State. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/BIz9Hb3kxnV09vNlgPaSiYj0Q

Grantee of land becomes owner of trees that were already existing on the land at the time of the grant if tree value did not exceed a particular amount prescribed under the Karnataka Land Grant Rules for their assessment. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/5KXStZ1jS7kNtNxVoh7WKE1mK

Deputy Commissioner cannot reject conversion of land after the expiry of four months stipulated under Section 95(5) of the KLR Act since conversion is deemed to have been granted due to inaction on the part of the Deputy Commissioner. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/hLzAXMWpjk32KpZvlhAuYSaLU

Karnataka Land Revenue Act. Conversion of land cannot be rejected only on the ground that there is no approach road to the land. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/h13tm4KVs6HNKKtABkmvPFiT6

Motor Vehicles Act. Term ‘Legal representative’ cannot be confined only to Class-I heirs under the Hindu Succession Act and is wider enough to include every legal representative who suffers on account of the death of a person. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/bRUToQpSOt3G6XXyqO8Z7oMda

Karnataka Land Revenue Act. Lands over which kumki privilege existed can be granted to any person, if he is able to establish that he is in unauthorised occupation over the said land prior to 14th day of April 1990. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/gmQ8GfQVwpEAQ6Ol2LYK4U6dQ

Karnataka Land Grant Rules. Deputy Commissioner cannot impose condition of non-alienation while granting permanent ownership as per the terms of the grant after expiry of the initial lease period. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/28cjr5OyPUKdyAhUZ97MHl3CE

Aided educational institution, to which an employee is transferred as a result of being surplus, is bound to accept the employee so long as it seeks grant in aid for the post in the institution. Karnataka High Court.

https://www.dakshalegal.com/judgements/actionView/fR6Wm8hXwR54cjTSC7xOGy8rO