Sri. Sai Keshava Enterprises and others vs The State of Karnataka and others. Writ Petition 8851/2020 and connected matters decided on 7 January 2021.

Judgment Link: http://judgmenthck.kar.nic.in/judgmentsdsp/bitstream/123456789/357096/1/WP8851-20-07-01-2021.pdf

Relevant paragraphs: 1. The main issue involved in these writ petitions is: “Whether the State Legislature has legislative competence to enact sub Rule (7) of Rule 42 of the Karnataka Minor Mineral Concession Rules, 1994, authorizing collection of entry fee from a person who transports certain category of minor minerals from other States with valid transit permit to the State of Karnataka?”

25. A careful perusal of the impugned sub-rule in the present petitions shows that it deals with only transportation of processed building stone materials from other States with a valid permit. It provides for levy of amount of Rs.70/- per metric ton from the person who transports processed building stone material as mentioned in the impugned sub-rule from other States to State of Karnataka with a valid permit.

32……the State Legislature is empowered to make a plenary legislation by invoking Entry-66 of List-II. However, the subject of regulating mining operations outside the State is not included in entry-66, List-II. Entry-66 is about prescribing fees in respect of any of the matters in list-II. Entry-23 in List-II is about regulation of mines and mineral development subject to the provisions of List-I with respect to regulation and development under the control of the Union. The field is occupied by the said Act of 1957 enacted by the Union Government which does not provide for levy of fees as provided in the impugned sub-rule. Moreover, the State Government has not enacted any law in terms of entry-66 of the said list. Assuming that such a power to levy fee is vested in the State Legislature by virtue of Entry-66 of List-II, a rule making power can be exercised provided that a law is enacted by the State Legislature authorizing such a levy by making rules. No such law has been enacted.

33. As the State Government has no legislative competence to make rules for levy of transportation fee or charge on minerals lawfully excavated in other States, it is not necessary for us to go into the question of quid pro quo regarding existence of co-relation between the fees collected and the services being rendered.

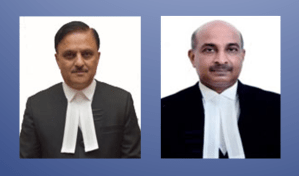

Compiled by S. Basavaraj Advocate Daksha Legal.