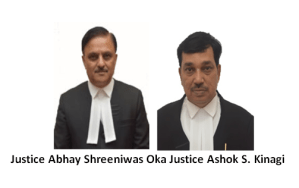

The recently concluded, longest Virtual Court via video conference by the Karnataka High Court (Chief Justice Abhay Shreeniwas Oka and Justice Ashok S Kinagi) in Securities Exchange Board of India vs Franklin Templeton Trustees Services Pvt Ltd & others (Writ Appeal 399/2020 and connected matters decided on 24 October 2020), is a clear indication of the emerging global and transnational disputes redressal process via Virtual Courts.

it is said ‘Sometimes it takes a disaster to bring humanity together‘. Radio was on the frontlines in both World Wars. It brought populace together. In one of the greatest speeches, Charlie Chaplin, in the movie “The Great Dictator” says.. “the aeroplane and the radio have brought us closer together. The very nature of these inventions cries out for the goodness in men, cries out for universal brotherhood, for the unity of us all.” Flipside of this technological wonder was witnessed during the Rwandan genocide against the Tutsi. Radio Télévision Libre des Mille Collines (RTLM) broadcast from July 8, 1993 to July 31, 1994 played a significant role in inciting the April–July 1994 Genocide.

Today, we are witnessing another manmade disaster called Covid-19. However, the resultant lockdown and closure of courts have opened new avenue of communication in the form of Virtual Courts. The judiciary is now fully equipped for disputes resolution via video conference subject to minor & avoidable glitches. Disposal of cases at preliminary hearing and admission stage matches regular court scenario.

The matter in Securities Exchange Board of India vs Franklin Templeton Trustees Services Pvt Ltd & others was heard from August 12, 2020 in the afternoon session through video conferencing. The hearing concluded on 24th September 2020. The record of these writ petitions ran into more than 5,000 pages. The cases were heard even during the Court holidays on 29th August 2020 and 19th September 2020 . The hearing through video conferencing was conducted on 25 working days for total 61 hours without any major glitch. It enabled lawyers to appear from London, New Delhi, Chennai, Mumbai and Bengaluru. The cause title shows several legal luminaries appearing for the parties. While Mr. Tushar Mehtha, Solicitor General of India logged in from Delhi. Mr. Harish Salve, Senior Advocate logged in from London, UK. Mr. Arvind Datar, Mr. Ravindra Shrivastava and Mr. Janak Dwarkadas, Senior Advocates and the instructing counsel logged in from Delhi. Mr. Uday Holla, Mr. K.G. Raghavan and Mr. Adithya Sondhi, Senior Advocates and Mr. M.B. Naragund, Additional Solicitor General of India logged in from Bangalore.

In the usual fairness, the Chief Justice bench has noted the compliments given by the Advocates for service rendered by the Registrar (Judicial) Shri. K.S. Bharath Kumar and his team as well as Shri. B.M.Satheesha, Shri.C. Shashikanth and Mrs. T. Bhagya, Court Officers.

Large number of documents forwarded by the learned counsel through e-mail during the course of hearing were efficiently handled by the team and were immediately placed before the Court. The Court has expressed appreciation for service rendered by the aforesaid members of the staff, Shri. N.Suresh, Hardware Engineer and the team of Computer Committee.

The issue involved. The entire dispute revolves around winding up of six Mutual Fund Schemes of Franklin Templeton Trustee Services private Limited (the Trustees). The investors who challenged the winding up contended that the discretion conferred on a Mutual Fund under sub-clause (a) of clause (2) of Mutual Fund Regulation 39 was subject to the fulfillment of the conditions as provided in clause (15) of Regulation 18 and that consent of the unit-holders was required for winding up, in view of clause (15) of Regulations.

The Trustees contended that the decision to wind up the Schemes was pursuant to the express provisions of the Mutual Funds Regulations, as contended in the statement of objections filed by SEBI and that no approval from the unit- holders was required for taking a decision regarding winding up.

The Hon’ble Supreme Court, by its order dated 19 June 2020, transferred all the matters pertaining to the dispute, to Karnataka High Court with a request to the Hon’ble Chief Justice to take up matters himself in a Division Bench.

The Judgment: The Karnataka High Court has held that;

(1) Regulations 39 to 40 of the Mutual Funds Regulations are valid.

(2) When the Board of Directors of a Trustee company, decides to wind up a Scheme by taking recourse to sub-clause (a) of clause (2) of Regulation 39, the Trustee company is bound by its statutory obligation under sub-clause (c) of clause (15) of Regulation 18 of obtaining consent of the unit-holders of the Scheme by a simple majority.

(3) A notice as required by clause (3) of Regulation 39 can be issued and published only after making compliance with the requirement of obtaining consent of the Unit-holders.

(4) Considering the duties of the Trustees under the Mutual Funds Regulations, they perform a public duty. Therefore, when it is found that the Trustees have violated the provisions of the SEBI Act or Mutual Funds Regulations, a Writ Court, in exercise of its jurisdiction under Article 226 of the Constitution of India, can always issue a writ of mandamus, requiring the Trustees to abide by the mandatory provisions of the SEBI Act or the Mutual Funds Regulations.

(5) No interference can be made with the decision of the Trustees dated 23rd April 2020 of winding up of the said Schemes. However, the decision can be implemented only after obtaining the consent of unit-holders as required by sub-clause c) of clause 15 of Regulation 18. Issue No.(v) is answered accordingly;

(6) In exercise of the powers under Section 11B of the SEBI Act, SEBI has no jurisdiction to interfere with the decision of winding up of a Scheme made by taking recourse to Regulation 39 (2)(a).

Compiled by S. Basavaraj, Advocate, Daksha Legal